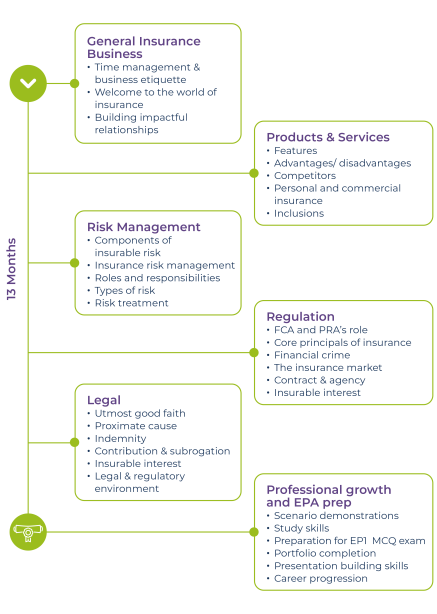

An Insurance Practitioner apprentice can bring significant value to your business by supporting the efficient sale, renewal, and management of insurance products. With training in risk management, insurance regulations, and customer relationship building, they can help you navigate the diverse insurance marketplace while ensuring compliance with industry standards. Their understanding of both personal and commercial insurance products enables them to provide tailored solutions to clients, enhancing customer satisfaction and retention. Apprentices are also equipped with skills in time management, business etiquette, and handling legal and regulatory aspects, ensuring smooth operations and reducing risks associated with financial crime and non-compliance. Ultimately, their contribution can streamline processes, improve customer interactions, and support business growth.