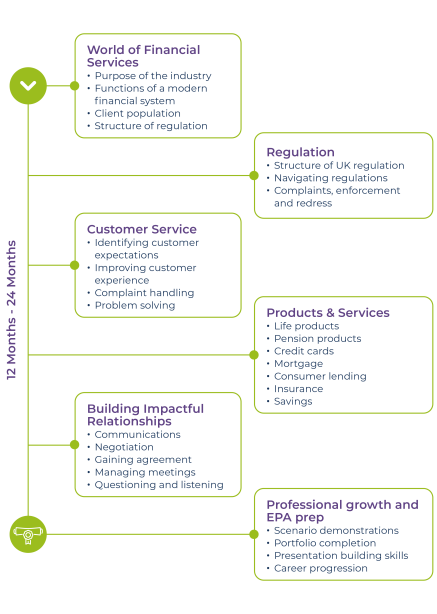

A Senior Financial Services Customer Advisor apprentice can provide significant value by enhancing customer service and improving client satisfaction in your financial institution. With in-depth knowledge of financial products such as pensions, mortgages, life insurance, and savings, they can offer tailored advice, resolve complex customer queries, and ensure that clients fully understand their options. Their understanding of UK financial regulations and ability to navigate compliance ensures your business operates within the legal framework, mitigating risks. Apprentices also bring skills in problem-solving, complaint handling, and building strong customer relationships, helping to improve the overall customer experience and retention. Their professional communication and negotiation skills contribute to more effective meetings and higher client satisfaction, ultimately driving business growth.