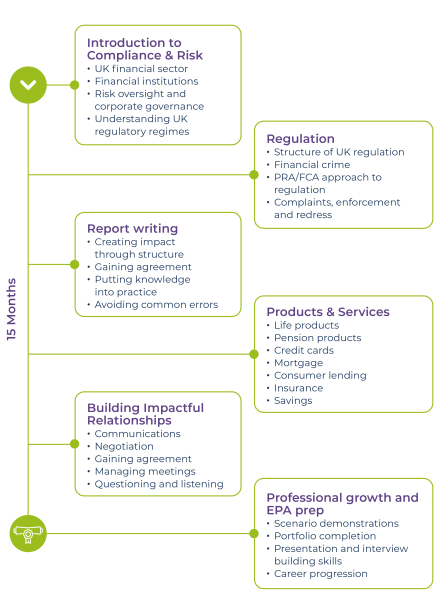

A Compliance and Risk apprentice can add substantial value to your business by helping ensure compliance with legal and regulatory requirements, particularly in the financial services sector. They are trained in understanding UK regulatory regimes, including the roles of the FCA and PRA, and can assist in preventing financial crimes such as money laundering. By supporting risk oversight, report writing, and helping manage complaints, they contribute to maintaining the integrity of your business operations. Their ability to build effective relationships, communicate clearly, and negotiate with clients or stakeholders ensures smooth operations and promotes a culture of compliance. Ultimately, their role helps mitigate risks, safeguard customer data, and protect your business from regulatory breaches.